Understanding the detail of each building allowance can get very confusing. For example, increasing the floor space of a factory would qualify as an improvement, however repairing a leaking roof after storm damage and restoring it to its previous condition, would not qualify as an improvement as it would not increase the income earning capacity of the building owner. “Improvements” are any extensions or additions (other than repairs) to a building, which are carried out for increasing or improving the industrial capacity of the building. Therefore, it is quite feasible for a building owner to have two separate capital allowance calculations – one for the building itself based on a particular cost and starting date, and another for the improvements, which would be based on a different cost and starting date. If the improvement qualifies for the deduction, then the allowance is based on the cost of the improvements and will start once the improvement is brought into use for the taxpayer’s trade. SARS treats an “improvement” to an asset as a separate asset itself for the purposes of capital allowances. the allowance will start in the year of assessment that the building is first brought into use, for the taxpayer’s trade.įor example, if Company B builds its own building and construction starts in July 2015, but due to building delays it only is completed in October 2016 and is brought into use for its manufacturing operations in November 2016, and assuming the company has a February year end, the building allowance will be claimable for the first time in the 2017 tax year (and not 2016).

#Can i use texturepacker for commercial use full#

unlike wear and tear, which is pro-rated per the number of months the asset has been used for, building allowances aren’t apportioned if the building is only used for part of a year.įor example, if Company A owns a building which it has used for commercial office space from 1 January 2016, and assuming it has a February year end, it will claim the full 12-month annual allowance on the building for the full 2016 tax year, and not only for two months i.e. lessor) will still qualify for the building allowance deduction. If the building owner leases to a tenant, and the tenant uses it in line with the Income Tax act provisions for building allowances, then the taxpayer (i.e. the taxpayer who incurs the cost (either by constructing himself or purchasing the building) is eligible to claim the building allowance. However, broadly speaking, they all have the following important factors in common: The conditions attached to these allowances, as well as the rates, differ according to the purpose for which the building is used.

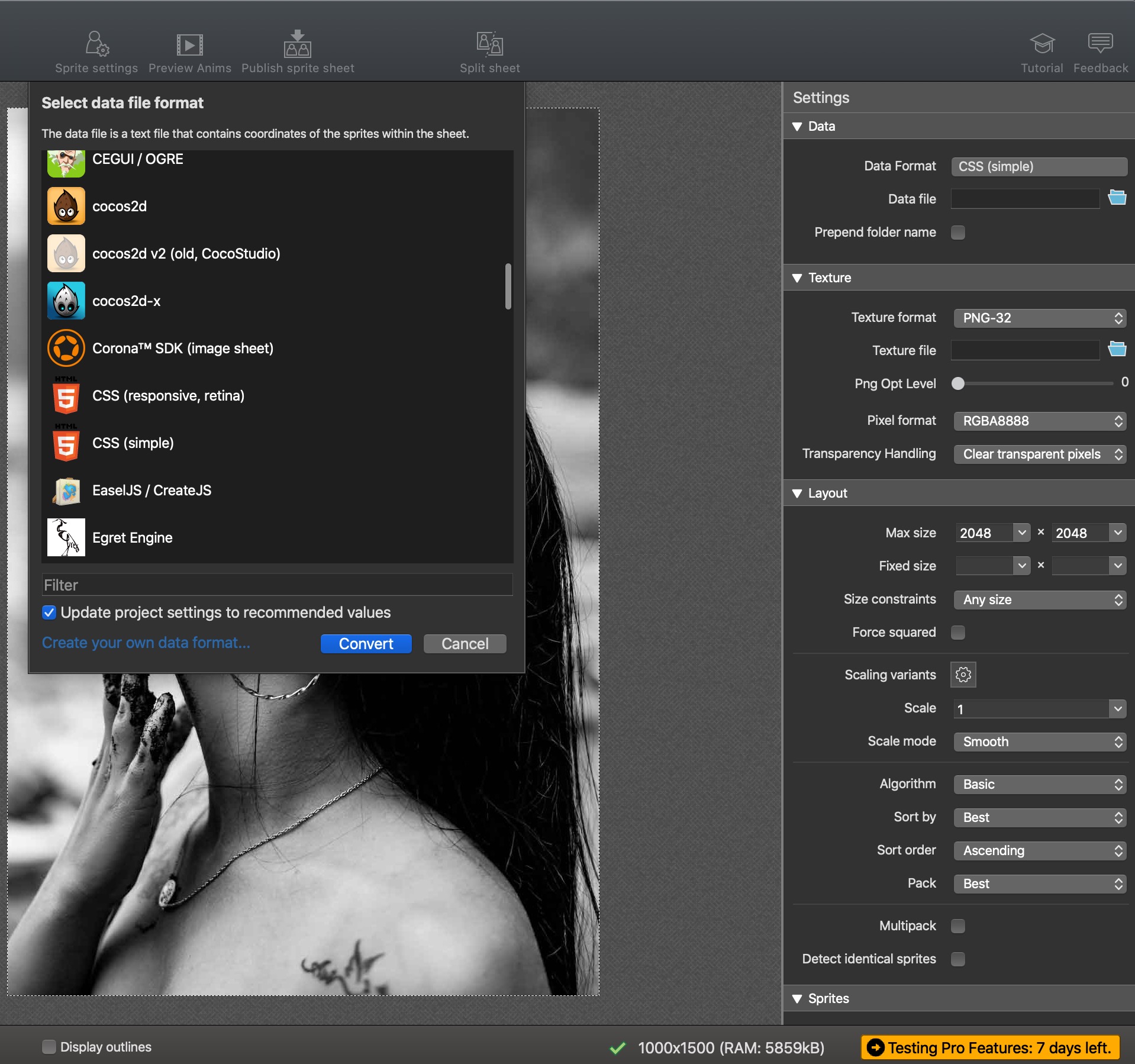

But, there are certain annual capital allowances which building owners can claim. Don't fret, below is a breakdown of the exact clarity you’re looking for.Ī must-know is, wear and tear allowance can’t be claimed on the cost of buildings because they’re permanent structures. “Aren’t they all the same?” is the question lingering in your head. A huge sigh of relief because… finally, construction and renovations are complete! And, just when you thought the worry was over, you realise that the differences between the building allowance and renovations aren’t clear to you. However, it's drawing a black box instead of the actual sprites.The cement is all used up and the bricks have been laid exactly where they need to be. I'm trying to use TexturePacker with LibGDX to animate a strip with player animation.

0 kommentar(er)

0 kommentar(er)